work opportunity tax credit questionnaire (wotc)

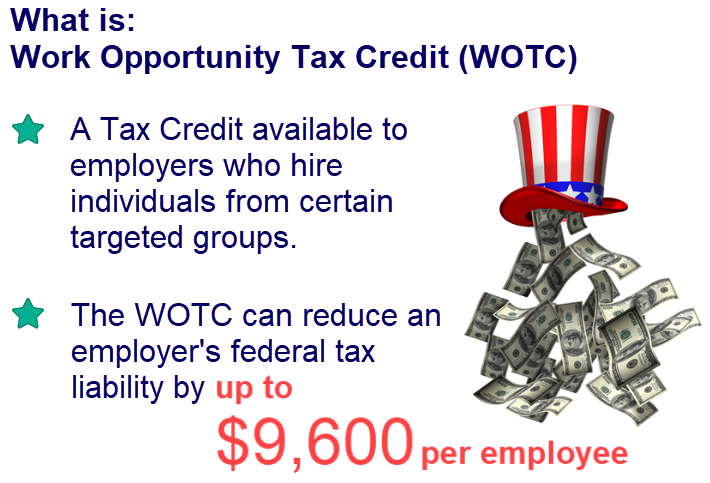

Web 2 days agoCompanies can receive tax credits as high as 9600 per eligible individual and WOTC will help offset any federal tax liability owed. Web In December 2019 Congress extended the WOTC to December 31 2020.

Fillable Online Work Opportunity Tax Credit Wotc Survey Fax Email Print Pdffiller

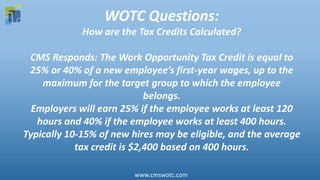

Web The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to.

. Weve spoken with more than a. As part of that extension the government extended the tax credit regarding Empowerment. Web The tax credit amount under the WOTC program depends on employee retention.

The goal is to help these individuals become. Work Opportunity Tax Credit Statistics for Louisiana 2021. The Work Opportunity Tax Credit known as WOTC is a federal tax credit created by the Department of Labor available to employers for hiring individuals.

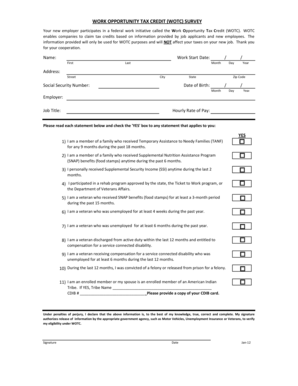

Web WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers. Web More information about the Work Opportunity Tax Credit can be found on the US Department of Labors WOTC Homepage. The WOTC is available for wages paid to certain individuals who begin work on or be See more.

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. Web The program delivers larger credit amounts for more hours worked. Web Work Opportunity Tax Credit Questionnaire.

Web The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. For detailed information about Georgias. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont.

The credit for all eligible employees who work between 120 and 400 hours is 25 of their. Web If you have any questions please contact the Tax Credit Services Unit at 800 345-2555 or RA-BWPO-TaxCreditspagov. Web Happy Thanksgiving from CMS WOTC.

Web Work Opportunity Tax Credit WOTC The WOTC is a tax incentive for employers to hire certain hard-to-place job seekers. Web Internal Revenue Code of 1986 Section 51 as amended in administering the Work Opportunity Tax Credit WOTC certification process. Is there a minimum amount of hours an.

Web WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Web The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced. We would like you to know that although this.

Web The Work Opportunity Tax Credit is a voluntary program. Please take this opportunity to complete an additional applicant assessment. Work Opportunity Tax Credit WOTC.

For most target groups WOTC is based on qualified wages paid to the employee for the first year. Law designates the SWA as the. Web Lawmakers should support businesses that employ Missourians in need of a job by augmenting the time-tested federal Work Opportunity Tax Credit with a state.

How Does The Work Opportunity Tax Credit Work Irecruit Applicant Tracking Remote Onboarding

Employment Incentives Work Opportunity Tax Credit

Wotc Calculator Management Tool Equifax Workforce Solutions

Work Opportunity Tax Credit Provides Help To Employers Kemper Cpa

Work Opportunity Tax Credit What Is Wotc Adp

Wotc 101 Get Tax Credit For Hiring Veterans The Long Term Unemployed

Wotc Wednesday Are The Work Opportunity Tax Credit Forms Required Youtube

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

Peoplematter Tax Credit Process Fourth Hotschedules Customer Success Portal

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

Work Opportunity Tax Credit What Is Wotc Adp

Alvarez Marsal What Are The Benefits Of Claiming The Work Opportunity Tax Credit Claiming The Wotc Can Save A Company A Significant Amount Of Taxes As Well As Enhance The

The Work Opportunity Tax Credit S Most Frequently Asked Questions

%20how%20to%20claim%20it%20for%20my%20business.png)

What Is Work Opportunity Tax Credit Wotc Should You Apply For Wotc Nskt Global

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

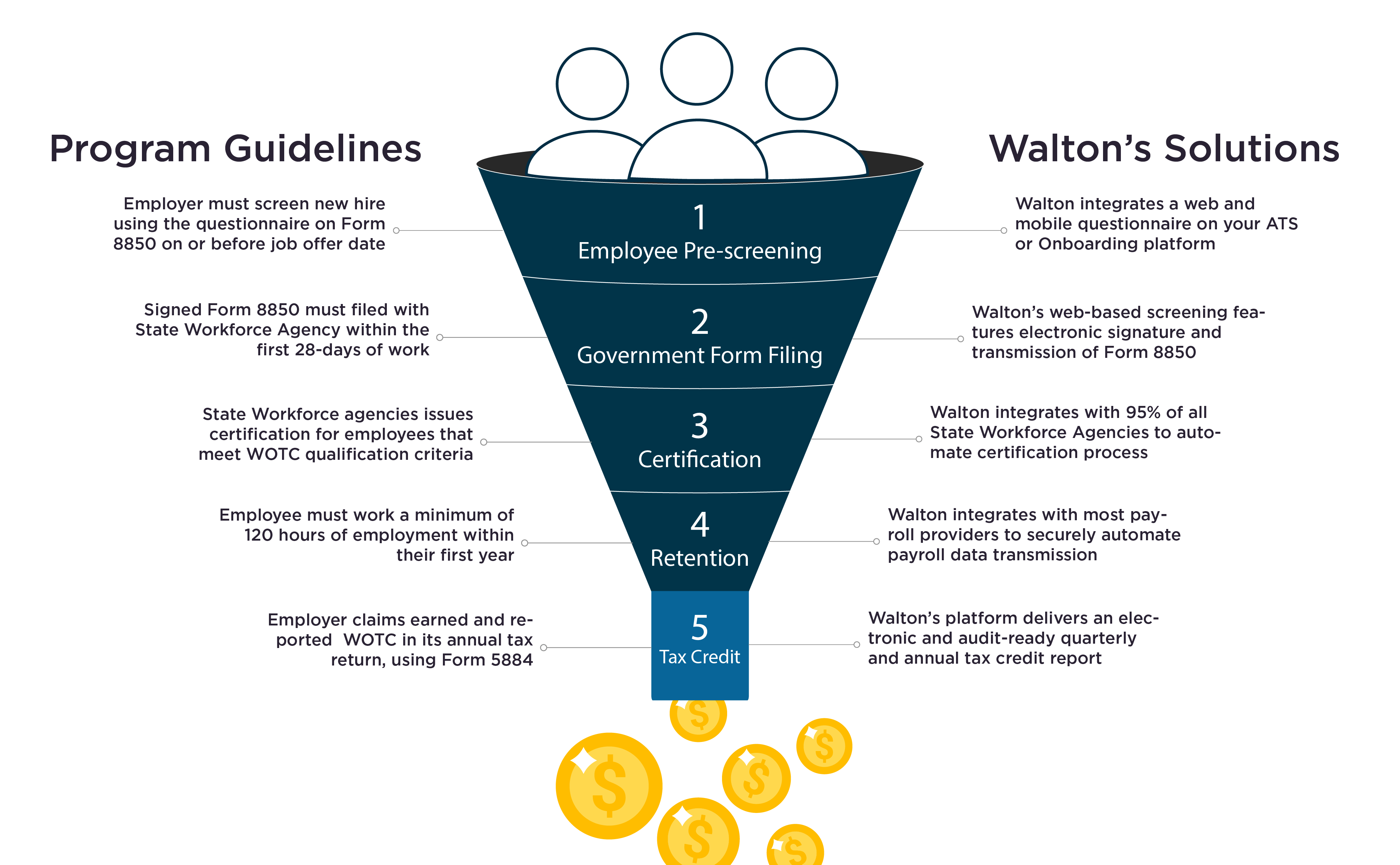

Work Opportunity Tax Credits Wotc Walton