Flat tax

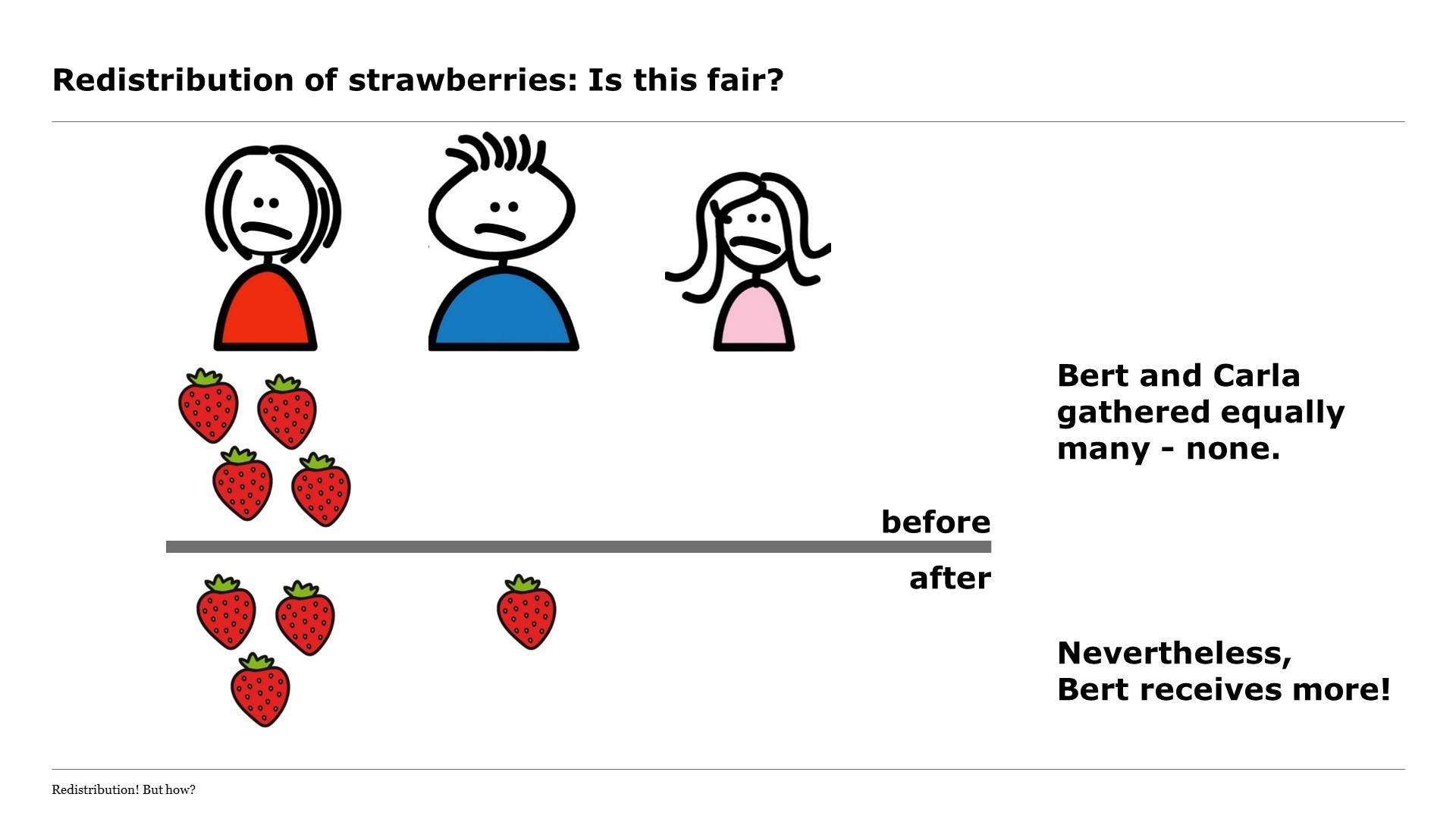

Unlike the current system a flat tax is simple fair and good for growth. A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets.

Flat Tax Definition Examples Features Pros Cons

Depuis le 1er Janvier 2018 les revenus patrimoniaux plus particulièrement les revenus du capital sont soumis au Prélèvement Forfaitaire UniquePFU que lon appelle.

. It now has a base value of 156000 based on the 2 tax increase allowed by Prop 13. What Is a Flat Tax. Graduated rates starting as low as 15.

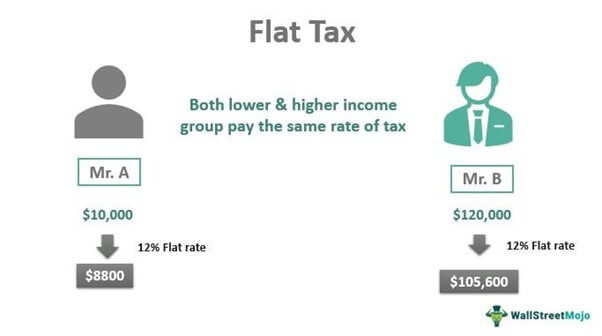

Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. California state tax rates and tax brackets. For example a tax rate of 10 would mean that an individual.

In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. A flat tax of 35 applies to the taxable income of a corporation that has taxable income for the year equal to or greater than USD 18333333. Georgias income tax is now scheduled to convert to a flat rate of 549 percent eventually.

For tax returns filed in 2022 California state tax rates run from 1 to 123. However many flat tax regimes have. Your unit cost 100000 to build but.

Therefore except for the exemptions the economic. Assume that the government imposes a flat tax rate of 15. Peter will pay 15 x 40000 6000 in annual taxes leaving him with 34000.

An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets. Instead of the 893 forms required by the current system 4 a flat tax would use. Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place.

Mississippi will have a flat tax as of next year with a 4 percent rate by 2026. Most flat tax systems or. A 1 mental health services tax applies to income exceeding 1 million.

In the United States payroll taxes are considered flat tax as all taxpayers are required to pay payroll tax at the same tax rate of 153 in total. James will pay 15 x. What Is a Flat Tax.

A new structure that will be assessed at the market value of a new unit with similar structure example. The Flat Tax This new and updated edition of The Flat Tax sets forth the flat-tax plan developed by Robert Hall and Alvin Rabushka senior fellows at the Hoover Institution. A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

However the US government. Now lets say you build an ADU granny flat garage conversion unit valued at.

Pros And Cons For The U S Of Flat Vs Progressive Taxes Toughnickel

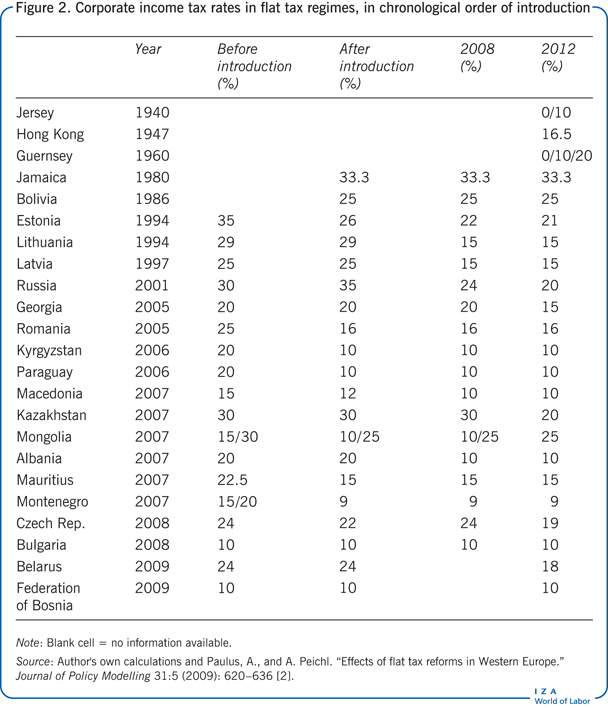

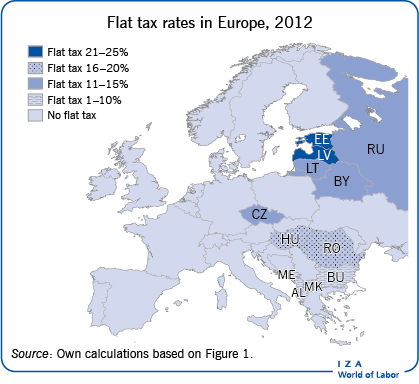

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

1 Flat Tax Revolution In Europe Country Introduction Of Flat Tax Income Download Table

Arizona S Lowest Flat Tax In Nation To Take Effect Next Year Office Of The Arizona Governor

Flat Taxes Cartoons And Comics Funny Pictures From Cartoonstock

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

The Totally Baffling Idea Of A Flat Tax Matt Bruenig Dot Com

Cruz S Flat Tax Vat Would Cut Revenues By 8 6 Trillion Tax Policy Center

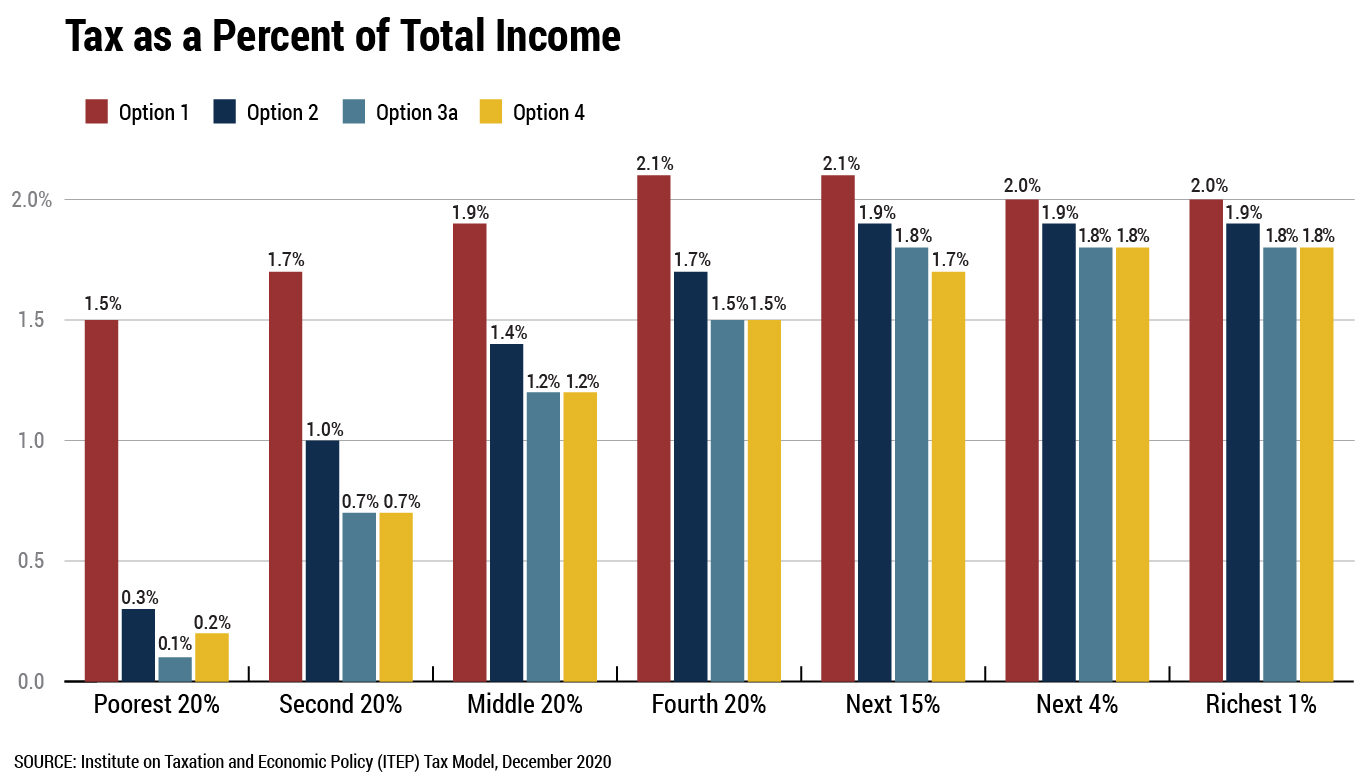

Comparing Flat Rate Income Tax Options For Alaska Itep

The Flat Tax Falls Flat For Good Reasons The Washington Post

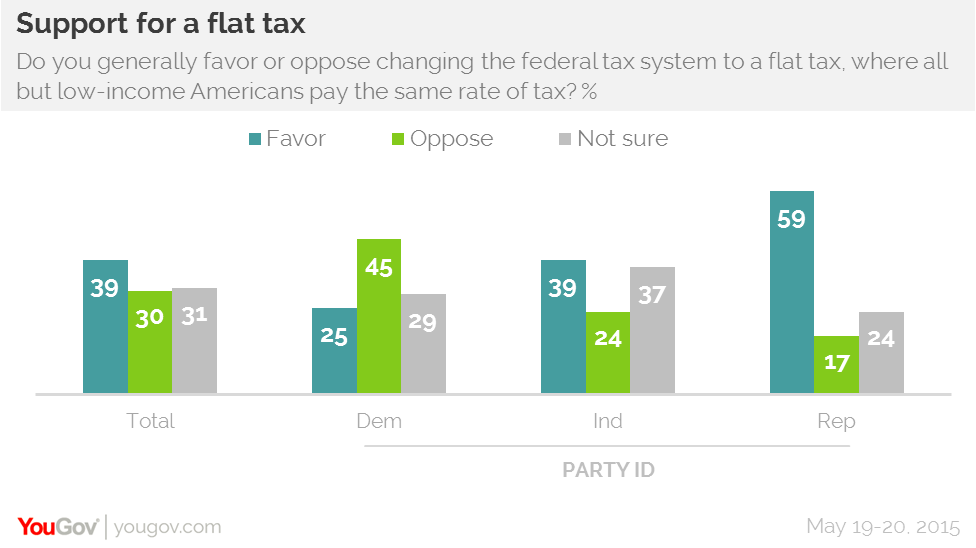

Most Republicans Back A Flat Tax Yougov

Armey Flat Tax Distributional Tables Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Tax Migration Everchem Specialty Chemicals

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

Flat Tax In Other Countries Should The U S Convert To Flat Tax

An Axiomatic Case For The Flat Tax Thinkmarkets

Illinois Issues Flat Vs Graduated Income Tax Illinois Public Media News Illinois Public Media

Use Unprecedented Surplus To Move Wisconsin To A Fair Flat Tax Maciver Institute